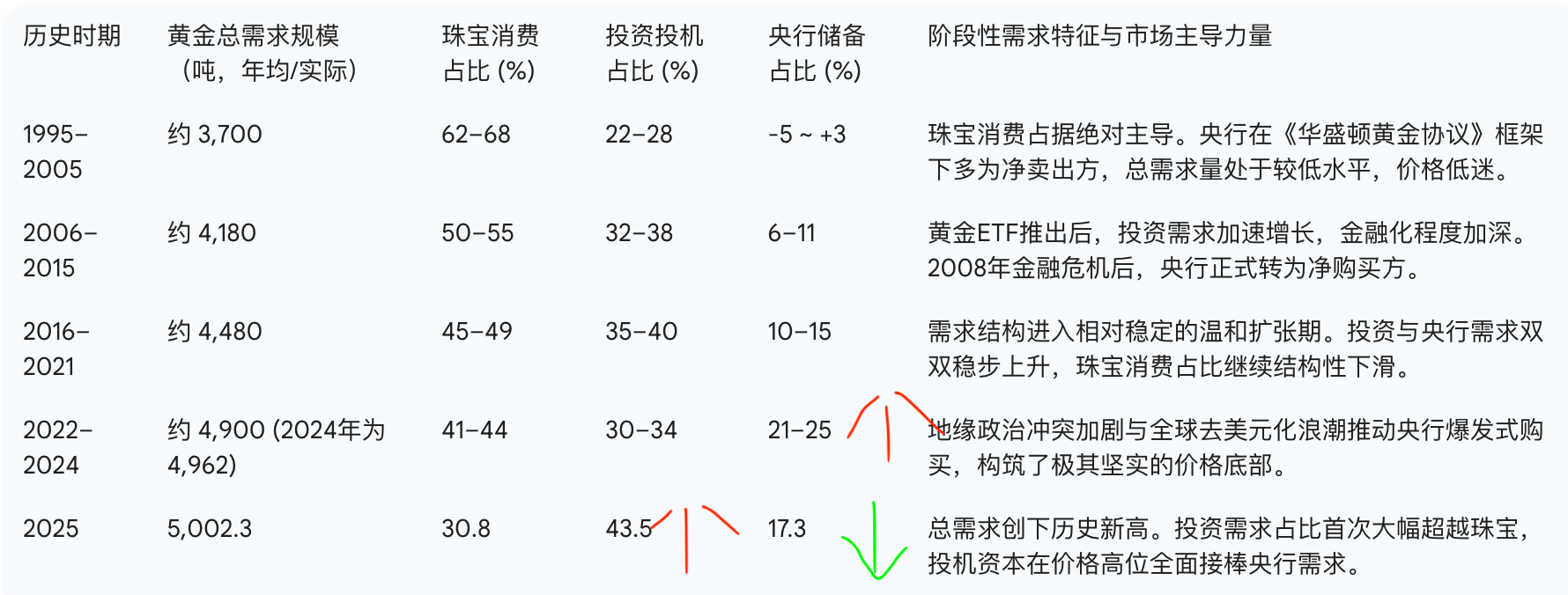

黄金买方里,央行是价格不敏感的长期推动力量,珠宝是价格敏感的长期推动力量。投资需求是2025年的主要买方,但是投资需求有较大的投机性,依赖价格动能,价格动能停下来的时候,投资需求的回撤,带来的黄金价格回撤可能非常大。

Quantity is a miracle.

黄金买方里,央行是价格不敏感的长期推动力量,珠宝是价格敏感的长期推动力量。投资需求是2025年的主要买方,但是投资需求有较大的投机性,依赖价格动能,价格动能停下来的时候,投资需求的回撤,带来的黄金价格回撤可能非常大。

社会建立在信息之上。

文字,语音,表情,图片,视频都是信息,信息有质量的高低。

高质量的信息洞察事情的本质,决定关键发展方向,低质量的信息干扰判断,产生无用功。

高质量的信息具有精炼的特征,比如在海量的情绪,养殖,天气,疾病,消费偏好,外部市场冲击等因素中,“周期”就是精炼描述猪肉价格现象的高质量信息。矛盾论也指出要抓住主要矛盾,主要矛盾就是精炼的高质量信息。

获得高质量信息的一个途径是输出,输出能帮助自己思考什么是核心,关键,本质的信息,这样就能让自己获得高质量的信息,所以要想一万字,说/写一百字。

脑总发了个分析A股和币圈流量驱动的追热点模型,分析的很有层次,值得学习。

A股和币圈因为散户在交易上占主导,所以出现了特别的交易模型,就是追热点。美股也有追热点的情况,但是因为主要交易由机构投资者主导,相对更加看重估值,行业趋势等长期逻辑,所以追热点的成分相对较少。

追热点脑总做了两种分类:1)即时事件驱动,流量从1->0,比如Trump喊话。2)逐渐成长的病毒式传播,流量从0->1,逐渐到达顶峰,比如狗狗币,GameStop。

对于即时事件,也有套利空间,因为热度是从Trump的关注粉丝->专业圈子->大众媒体->普通人,这个过程需要时间,所以可以提前布局。对于病毒式传播,主要关注哪些话题具备传播性,一个事物,你是否想发到群里,群里看到的人是否想发到别的群,如果都是,则具备病毒式传播的条件。其还分析了一些具体的如何判断A股标的具备传播性的识别特征。

什么时候退出?当流量达到最高峰,到达普通人,比如外卖骑手开始炒航天,这个时候热度就失去了继续传播的能力,流量到顶,价格到顶。掌握这些不只是要精确的判断热度,事件,还要在物理上有大心脏,对恐惧的免疫,对贪婪的冷漠,很少有忍能把这些玩的很顺,成功来自对人性的精准掌握,反面也会被人性所拖累,让自己受损失。

跨年的烟花和气球会回来的,那将是一个充满向往和信心的未来。

Ant-G联盟,Nvidia Rubin VS TPU的未来之战

太空数据中心有能源,散热,和网络优势,SpaceX,XAI有非常大优势

Taiwan Semi的保守策略拉慢了芯片供应速度,给了Intel机会

量子计算的真正领导者是Google,IBM,Honeywell,而不是其他概念股

Investing is search for the truth.

Reacting to the endless feed feels uneasy. The feed will never serendipitously align with my true desires.

I need to face what I really want.

This passive mode of receiving information simply doesn't work.

做简单,但不容易的事,“简单”能让自己搞懂为什么,“不容易”能积累自己的壁垒。有人说lex fridman的视频几个小时的英文听不下来要看AI summary。但是段永平的采访全中文的,大部分人还是会选择看精华,这是建立自己壁垒的好机会。

昨天讨论到gemini3要来的时候,开玩笑说自己是“岚·Gemini·Grok·Deepseek”,现在想想这其实不是一个玩笑,AI的能力超过我太多,但是作为一个组合体,我发挥的价值远远远大于原来没有AI的我,得非常认真的考虑不断用AI提升自己的工作流,提升自己。

如果将能力进行公式化,能力=我x杠杆,以前我的能力=我的知识,现在我的能力=我X模型的能力,模型的能力在不断发展,我被动享受了这个增益,但是最能撬动这个杠杆的,是我的本身,我的10%的提升,能带来10倍的收益。

所以在精力健康专注力,知识逻辑上的投资,是非常值的。

A startup is in constant search of a profitable, scalable business model.

It's about testing your assumptions as quickly and economically as possible.

There are three main things to test:

The Hollywood model is a good way for startups. Every movie is a startup. There are four phases of Hollywood movie-making: DEVELOPMENT => PRE-PRODUCTION => PRODUCTION => POST-PRODUCTION. Making a movie is like starting a startup:

不用把自己塞满

Being a value investor means you look at the downside before looking at the upside

破坏性创新是个不断上演的故事,小公司在小市场发扬壮大,拓展到主流市场,主流市场的大公司,因为会影响自己营收阻力,对新的产品技术方案犹豫不决,最终被小公司取代。

Nvidia对通用并行计算的创新->威胁intel的地位,intel因为自己的营收阻力,对并行计算投入不足->并行计算最终成为主流,intel被边缘化->Nvidia成为新的霸主

特斯拉在电动车领域的创新->威胁丰田等传统厂商,传统厂商一边推出电车应对,一边要抱住自己的营收主力油车->最终特斯拉成为新的霸主

OpenAI对信息查询的创新->威胁Google的信息搜索地位,Google要保住自己的搜索营收,这对和OpenAI争夺下一代信息查询系统的目标产生阻力-> ?

为什么Google可能倒下,因为Google的搜索成功就是Google下一个成功的绊脚石,但是好在Google有持续性创新的基因,最近也能看到Google开始对自己的搜索动刀了,但能否应对这次市场创造性创新的冲击,还有很大悬念。

如果我想要成为一名专业的分析师,我应该做的是验证,思考加深度写作,而不是沉迷于海量的信息与观点。

听完Lex Fridman采访 Pavel Durov,太为自己沉迷奶头乐惭愧了. do the real thing.

和应试教育最后分道扬镳的导火索是英语抄单词首字母大写不对要改成小写,f只占两行不对下面要多一行弯弯顶天立地。原以为Blue英语会很好结果评价又是比较差的那批,虽然这也很好解决多练习几次就好了。但是这个却是个好时机让我能想一想到底走什么教育路线。

一个人的精力是有限的,在教育资源贫瘠的社会,一切能区分是否优秀的工具都会被深度应用,字体,作文词藻的华丽,审题都会用来大做文章,英语小学阶段不好区分,就用书写工整等来判断是否对,而不是直接去判断一个人的语言能力,因为要考虑到教的东西很少,要照顾好不同起点的学生,如果不把命题局限在课内,很难用一套尺子去量所有人。而可能的内容要考虑大部分人能懂,但是又要区分出分数,就必然在一些枝枝节节上下功夫,让你在这些地方卷。

但是教育认证资源持续会贫瘠,高等教育认证怎么也只会属于少数人,如果确认自己不是这少数人,去陪跑而不是去真正的追随兴趣去学,是否是有意义?我们处在教育资源开始极其丰富,教育认证资源持续人为稀缺的年代,打什么牌非常关键。

播客,电影,音乐,游戏这些海量的探索资源,我觉得可以尽早开放给娃,让尽早给娃去玩iPad,玩电脑,玩游戏,引导其输出。

“结构”是个神奇的东西,单一的元素通过不同的结构组合,能产生全新的性质。细胞不同的排列组合就是坚硬的骨头与柔软的皮肤直接的巨大差别。不同的金属进行组合的合金往往能呈现全新的特效。DNA的排列顺序就是生命的遗传密码,决定了生物体的一切性状。改变顺序,就改变了信息,也就改变了最终形成的蛋白质和生命体。

排兵布阵的不同,让弱小的团队也能发挥出强大的战斗力。拱形桥向下的重力巧妙地分解为向两侧的推力,从而承载巨大的重量。

思维实验:想象一块巨大的大理石,

结构提供的是可能性,是概率,是涌现的本质,雕刻成滑梯,就是儿童的乐园,雕刻成无窗的房子,就是一个监狱。结构具备以下特征:

为什么有的人很多人嫌弃,有的人很多人追捧,就是不同的人有不同的结构,给别人提供了不同的可能性,有的人是个好的领导,结构展开成喜分钱,善为下属争福利。有的人自私封闭,别人在这里讨不到任何好处,像一个封闭的石头。

维持一个精巧的结构不容易,需要巨大的能量,耐心,时间,与智慧。TK是我很佩服的一个精巧结构,人们能在这里获得健康,职业,生活,规律的指引,也提供了粉丝讨论的空间。他肯定也为朋友提供了一个稳定的有效的求助渠道,信息中转渠道。这是他几十年不断雕琢这个结构的结果。

登高过程中,会听到很多声音,很多评价,这都不重要,重要的是爬到更高处,收获更高的视野。

从2021年CT开始,就持续有肺结节出现,还在随访阶段,很是苦恼,安排后事的节奏也加快了。

然后最近查慢性咽炎,有痰的症状,有一项原因是胃酸返流,这颠覆了我的认知,我从没想过又这种可能,然后继续查,发现胃酸返流除了刺激喉咙,导致不舒服有痰,还能导致肺部炎症,引发结节。且因重力影响,好发于肺部的下叶、背段或后基底段,这和我的结节位置吻合。可以加大怀疑胃酸返流导致结节的概率。

很开心找到一个健康风险,开始调整生活习惯,吃奥美拉唑观察一段时间。

目标放长远。以全面提升自己为目标,不投机。

原本以为通过结构化,批量化的方式,能提升记忆单词的效率,最后发现还是需要一个一个的去记忆理解,最快的方式还是最慢的那套:深度理解,多用。

经营利润率,自由现金流,债务水平,是硬指标,持续失血坚决不投

关注其资金来源,通常可能是:

无论怎么来,不能从客户来都是极其危险的信号,增发股票更是对股东不负责的表现。

通常来说,能力=决策质量。

优秀的决策来源于信息的丰富程度。信息来自自己对大量信息源的分析内化,成为自己的经验库。分析内化自己经验库的方式主要靠实践输出。

所以在目标领域大量输入,大量输出是锻炼我自己能力的关键。

Sold NVDA $160 covered call, expiring September 19, 2025, $10 premium.

神经网络的数学本质是概率空间,提示词工程则是帮助LLM在非常多的概率空间中找到较优解,来实现我们的目标,强化学习RL则是在现有的概率空间下,通过Post-training,来优化LLM的输出,提升较优路径的概率。都是优化路径概率,从条条大道中找到通向罗马的路,所以只要提示词构建得当,次级模型是能达到顶级模型的效果的,但这需要精巧的概率设计。

比如,从繁杂的群聊里面归类话题,总结事件进展,来龙去脉。如果提示词是:

请从群聊中,总结广泛参与讨论的话题,并给出事件进展,来龙去脉。

概率空间会非常宽泛,顶级模型可以很好的划分话题,分析来龙去脉,次级模型可能需要看运气,或者根本没法有效的切分话题。

如果改成:

1. 按时间顺序分析消息流,维护一个话题列表

2. 如果当前消息是对已有话题的讨论,则更新已有话题的讨论内容,将本条消息放到话题列表的消息流中

3. 如果当前消息是新话题的讨论,则创建新话题,将本条消息放到话题列表的消息流中

则概率空间大大收敛,从对全局的信息分析,变成对时间线的回复关系确认,简单很多,小模型也可以很好的完成。

当生成的结果,包含了幻觉链接,如何解决,比如:分享了⼀张⻋载充电宝的[图⽚](https://example.com/car_power_bank.jpg),并感慨其重量,LLM生成了一个不存在的地址,这个问题来源于提示词:

每个话题转换为一条清晰、完整的描述,说明信息点、问答核心或分享内容,如有链接嵌入[链接](URL)。

LLM错误的将原文:xx分享了一张动态图片的链接,但是链接并不存在,所以它自己生成了一张图片,并嵌入到回复中。

通常我们如果加限制词,比如检查链接的合法性,或者检查链接是否存在,是较难解决这个问题的,原因是原始Prompt的概率空间非常大,比较模糊,有非常多的错误路径能指向放置一个链接。在此基础上做裁剪是较难达到效果,因为永远有没有考虑到的情况。

如果我们直接进行概率收敛,缩减提示词,则好的多,比如:

每个话题转换为一条清晰、完整的描述,说明信息点、问答核心或分享内容,如原文有http/https的URL,则以markdown格式[链接描述](URL)包含在回复中。

http/https的URL将LLM处理的概率空间缩的很窄,从源头上提高了正确识别URL的概率。比模糊的要求+限定结果好很多。

所以,设计一个提示词,要尽量向具体,众所周知的事情上靠,不要在一个模糊的要求上,加上很多限制词。把自己想象成LLM,按自己写的prompt走一遍,想一想这个步骤我的自由发挥空间是不是太大,如果太大则需要继续精简。

这个视频提到的大脑机制:

昨天vibe coding翻车了,实现的功能就差一点点,但是这一点点死活调不好,越改越乱,sonnet 4不行换Gemini 2.5 pro救命,有时候能救过来,有时候一起翻车。无奈只能reset hard 然后硬着头皮读代码,精简结构。

Vibe coding的重要关键点:

technique:

对付娃,在想发火之前:我尽力了?我想了所有办法?还有其他方案吗?

如果都尽力了,随他去吧,接受现实,就这样了,冲别人发火也没用。

avoid bad case, target base case, looking for good case.

find long term unchangeable things:

宏观虽然重要,是一切经济的基础,但是宏观系统太过于复杂,信息难以及时获取处理,在对具体标的操作时,短期不确定高,不适合作为操作依据。

微观的问题,定义能很清楚,解法有很多样,适合在微观里寻找机会与乐趣。

From 《不要迷茫,不要彷徨》

经济危机是好事,它给了人审视自己的机会,此时宜健身,宜寻找尝试新机会,宜去杠杆。当经济危机一过,自己的成长+市场情绪的回来,就会轻舟已过万重山。千万别怪别人,怪市场,怪政策,为了挽回损失加杠杆,既解决不了问题,也掩盖了暴露脆弱点的机会。

Today I bought back my short puts on NVDL, the final loss is 69%. It was a big loss, and it's sad, but I finally got rid of it.

Keep moving forward. Do the right thing.

https://wallstreetcn.com/articles/3687254

From 大道:

你的每个决策都会对你的一生起到作用。你要"理性想长远"。

所谓要坚持做正确的事情其实就是:

- 发现错了就要坚决停止,

- 明知是错的东西就要坚决不做,

- 面临决策时首先考虑是非和长远而不是短期的眼前的利益。

From TK:

- 人的精神和肉体是统一的整体,相互影响。

- 你们试试,把两个嘴角上扬,做出微笑的动作,保持几秒钟后,就会感觉心里好像也有什么开心的事。

What I want to break now is:

I'm very bullish on Nvidia. Every dip or rise higher ignites my FOMO. I've profited a lot from that.

My strategy is to hold the stock and sell puts to earn premium to buy more Nvidia. If the price goes down, I just need to roll to the next week to expect the price to come back.

It has some risk and looks dangerous, but it has been fine in the past, as Nvidia has bounced back many times.

But this time, I learned what risk really is. When I sell puts, I'm exposed to the full loss risk if the stock goes down. The price went lower and lower. I needed to limit the loss by hedging, but I hadn't.

Today Nvidia's price went down to 110, and my position lost a lot. What a huge lesson.

Remember:

Hedging is a good tool. If I hedge well, I won't worry when the market goes down. Losses will be contained to a position and stop, then I'll have more time to wait for a bounce back. It's even possible to profit from hedging.

#hashtag: investment

Tomorrow is the result of today's choices.

Today's improvements will make tomorrow better. Today's setbacks will make tomorrow harder.

When I slice time into daily pieces, I live fully in the present moment. I can't defer tasks to some future time - I can only act now.

While today's happiness means nothing, what I truly seek is a better tomorrow. Therefore, I must take actions today that will help me grow and improve for the future.

The market's enthusiasm has been ignited by the news that the BIG BOSS will meet with tech leaders.

The YINN (3x bullish China ETF) has been on the rise. So I used my reserve money to try to take part in it. When I bought it, I just regretted that I couldn't earn much with this little money.

I felt uncomfortable, so I sold it with little profit.

Short-term trading success can create overconfidence, leading to risky behaviors like increasing leverage. Rather than chasing market predictions, I should invest in my personal development through the 'Ability Cycle' - continuously learning and improving my skills. This strategy provides more sustainable, long-term value for my life.

TELL MYSELF:

TGA is a buffer account it doesn't create liquidity itself. When its inflow and outflow is balanced, it doesn't create more money. But when some reason like debt deficit make TGA outflow bigger than inflow, the outflow will be the deposit in banks. Banks can use this deposit to loan to others, then money created. When the debt deficit resolved, TGA will draw money from banks then lead to less liquidity.

Is sleep.

There are 2 types of information: highly compressed and low compressed. You need low compressed information to build a good LLM because it has more details. People using tools to summarize books, podcasts, and articles is a good way to get quick news or rough ideas, but if they want the information to become their knowledge, the training process (reading, listening, and thinking about the whole piece of information) is inevitable.

Example: In Lex Fridman's newest AI podcast, they talk about many things including Deepseek, AGI, chips, and AI industries - you can roughly get an idea of what the trends are. But if you want to know why Google's Gemini has a longer context length (millions vs thousands) and how this feature will impact AI trends, you can't find it in any summary article. With these many details in your head, this "LLM" becomes more valuable.

Another example is English learning - it's impossible to just memorize vocabulary and learn grammar and expect to reason how to speak and understand English. You need to listen to and read enough materials to store sufficient information in your brain. Every method that doesn't let you experience more, but instead gives you compressed, structured content optimized for special tests, is rubbish.

When you have trouble choosing between following your passion and making money, it's almost always due to ignorance:

A good way to solve this is to gain more certainty. You can try working on things you're interested in. That will give you more information.

A trick for judging different kinds of work is to look at your colleagues:

And choosing options that may give you more options in the future is also a good way to face uncertainty (staying upwind). For example: if you're unsure whether to major in math or economics, choosing math is the upwind of economics - it will be easier to switch later from math to economics than from economics to math.

It's not a good idea to simply take the advice of "follow your passion", because you mostly hear it from famous people (who are working on what they're most interested in). Not everyone does great work.

When we write less, we think less, and that is bad. I choose not to be bad, so I will write more.

From: Writes And Write-Nots

When pursuing our dreams, we need consistent practice to achieve them. The more we practice, the stronger our neural pathways become, eventually making these practices effortless. Here are the key elements to building powerful habits:

My current practices include:

In the formula of information creation (Energy × Computation = Solid Information), energy is the most crucial component. When we feel low on energy, we should first focus on finding ways to improve our energy levels, rather than attempting tasks with depleted energy, which will only produce poor results.

Based on "Why Information Grows," we can express the fundamental relationship as:

Energy × Computation = Solid Information

There are three types of computational systems:

Each system can form networks that amplify their individual capabilities:

Computer networks compose human networks and have significantly enhanced human networking capabilities.

I believe we will witness the emergence of transformer networks(AI models + internet + human network), creating a new form of intelligence capable of generating information with unprecedented efficiency. This network maybe we can call it: "SKYNET".

Have a truly free life:

阿里看似亡于大环境,外部竞争,内部大公司病。实际亡于分家,分家导致的创新网络,人才流动网络瓦解,使生长在这一网络的创新能力,信息丰富度衰减。阿里云的成立基础是建立在蚂蚁,淘天深厚的底层网络积累上,大量的人才无缝拔插到阿里云,如果放在分家后,即使有阿里云的idea,以及高层加倍的投入决心,失去这一底层网络的支持,也只会是另外一个滴滴云,或者字节云,事倍功半。

所谓智慧不过是在不均衡系统里能量不断输入产生的自发性信息创造造成熵减的过程,作为系统的一份子要时刻感恩能量的输入,不要过分高估自己的努力,更多的时候应该去寻找能量密集的地方,持续挣钱的公司,不缺爱的人,富足的社会环境。千万别去快发不出工资举债度日的公司,千万别找从小缺爱的人,千万别去发展程度比较低的地方,你没那么大能耐,别想着多打几份工,多努力学习就能改变什么,就算是努力学习,也是为了去寻找,安家在能量更高的地方。

I need to create information!!!

从信息的角度,不均衡系统熵减,信息不断被创造,而计算机是这个过程的主要执行者,树是一个计算机,人也是一个计算机,社会也是一个计算机,有史以来最强大的计算机是人,人不断以指数级创造了这个社会的信息,现在的AI还是辅助人,增强人作为人去创造信息的工具。但是我们得承认,在不断能量输入的系统里,人肯定不是那个最强的计算机,现在的AI也不是,未来的AI可能是,也可能不是,一定会有一个更强大的计算机,更强的的去消化能量,创造信息,创造秩序。

In Judo, the key to success is to use the opponent's strength against them. Not use your strength against them. The bigger the ennemy are, the more potential the success is.

chatgpt是怎么出来的: 当强化学习,深度学习遇到瓶颈时,大家隐约发现了scaling law,更大的数据意味着更强的智能,在图像识别,人脸识别等领域都是如此,目前数据最多的人类知识库就是自然语言,于是从自然语言入手,gpt-1,gpt-2 gpt-3,不断扩充数据,模型规模,期望达到能在自然语言上对话的能力。最后在gpt-3.5成功了,自然语言chat是ai最新最振奋人心的突破方向。

沿着这个scaling law,特斯拉迅速转型,把fsd从人工代码建模,什么空间算法,运动算法,碰撞算法全不用了,完全转向ai,用数据去训练,得到了巨大的提升,使自动驾驶看到了希望

机器人的突破,比自然语言的突破更难的原因是数据,自动驾驶还有特斯拉的大量数据,可以直接拿来训练,市面上的机器人基本还处在特斯拉早期的人工写代码阶段,希望在特斯拉,英伟达已经开始了用ai来驱动机器人的探索,数据没有就人工制造,他们招人戴上vision pro,遥控机器人进行任务,这些遥控数据= 自动驾驶领域人类司机的驾驶数据,能让机器人学会走路,搬东西,扛炸药包往前冲等各种指令,只是受限于数据规模,会有较长时间的启动期才能走到chatgpt moment。

Personal coupon growth formula:

Personal Coupon Growth = Body × Knowledge: (Language & Logic) × Information × Action

move less, train more.

Whenever I reach my goals or await the outcome, a profound emptiness settles in, leaving me uncertain about my next steps.

The wait is unbearable - isolated and unsupported, I find myself irresistibly drawn to distractions, constantly refreshing for updates to kill time, and craving conversation. Yet, waiting is an indispensable life lesson. I must harness this time for introspection, learning, and self-improvement.

For if I succumb to the allure of fleeting gratifications, I risk forfeiting the potential for true liberation.

When emptiness:

Selling puts is a good strategy to earn money when the price is steady or slightly up. The pain comes from:

If you can bear the pain of not getting as much profit as buying stock, that small and steady profit will start to accumulate, and you will see the power of compounding.

I just changed the blog template to make it simpler. I also added a cat to my blog, so I'm not as lonely now 😊.

from:

to:

What I need to do in the short term to recover from training:

Biden can't tackle the INFLATION, so the path of least resistance is obvious: Do whaterver he can to get the votes, even though it's insignificant to solve the problem.

This is my learn note on the podcast. Follow me to get more. reference:

#hashtag: LearnThroughPodcast ValidEnglish

tk发了一条微博:“美国从红州限堕胎到到蓝州零元购,中国从《妇女儿童权益保护法》到医药集采,背后都是同一个原理。我在私下给一些朋友详细讲过这个政府第一性原理。可惜不能在这里说。但看了上面这四个仿佛完全扯不到一起去的例子,也许有人能自己想明白。想明白了这个原理,不仅能理解很多事情,也能预测很多事情。 ”

限制坠胎是Roe坠胎案被推翻,导致在联邦层面失去坠胎合法权 0元购是2014出的法案,盗窃950元以下商品等罪行从重罪降为轻罪,原因是加州等地方监狱人满为患

我的猜测是:这几个case都涉及到利益的再平衡,平衡就涉及到+和-,决策符合大多数人要求,但特别是0元购和坠胎案都广受诟病,坠胎案甚至一度让Republican掉了很多选票。是不是说涉及到复杂关系的时候,决策方永远选择短期阻力最小的路径去演化

The 401k is a dominant retirement plan in the U.S. This year, 4.1 million Americans turn 65 years old, but 49% of people aged 55-65 have nothing in their 401k account, and 10%-20% of retired people live in poverty. Why does the 401k not work as expected? And why is this a problem that will damage belief in the capitalist system?

Before the 401k, in the 50s to 70s, the U.S. had a pension system in the private sector. People would work in a company for 30 or more years, and the company would guarantee a fixed retirement income for the rest of their life. It worked well against the backdrop of lifetime employment and people not living as long as they do now.

The 401k came about by accident. It began when companies wanted to reward their executives, so they created a tax-deferred account to pay bonuses to their executives. The managers could get the money when they retired or left the company. There was a risk whether the IRS would tax the money, but in 1978, Congress passed a law to make it legal. That's how Section 401(k) came about. A retirement specialist, Ted Benna, found this law and used it to create a retirement plan for his company. He provided a matching contribution to his employees. If employees put money in the 401k account, the company would match the same amount of money. It was a win-win situation. The company got rid of the responsibility of the guaranteed pension system, and employees got extra money, tax benefits, and investment growth.

Why did the 401k become dominant in the U.S.? 1) The auto and steel industries declined, and a lot of corporations regarded pensions as a problem. 2) Reaganomics advocated individual responsibility, and the 401k shifted the responsibility from the employer to the employees.

Who can benefit from a 401k? Those who are high-income, disciplined, and have good investment knowledge. They don't need retirement money to live. But who falls out of the system? Those who are low-income, whose company didn't provide a 401k, or they didn't know how to invest, or they had to withdraw the money for an emergency.

The 401k reinforced income inequality. The rich get richer, of course, that tool was first designed for rich people. And normal people benefited from it due to government legislation. That is a common American model, normal people benefit from the elite's move. But the inequality still exists, millions of people falling through the cracks of the retirement system make the country driven toward socialism.

How to solve the problem? There is a plan called the Thrift Savings Plan. It's a retirement plan for federal employees, and Congress is considering expanding it to all Americans. When a company can't provide the matching contribution, the government will provide it.

Will it reduce income inequality? We still don't know, but one thing is clear, in the U.S., a comfortable retired life relies on the individual to make it happen. Retirement is a privilege, not a right.

This article is my learn note on the podcast. Follow me to get more. https://www.nytimes.com/2024/05/20/podcasts/the-daily/401k-retirement.html

#hashtag: LearnThroughPodcast ValidEnglish

I used to believe that if I keep learning, keep trying, I can live however I like, can be a brand new person. But now I have to admit that is wrong, I'm a person, my parents' son, Chinese, introverted. It's my nature.

I can't change myself, but I can make myself stronger, more resilient, more capable.

Democracies: The restraint of leaders in their rhetoric during heated elections is a key indicator. Autocracies: The ability to self-correct when wrong is crucial.

Scarce resources for person:

And inflation is also drive by Svarcity, if resources are scarce, the price will rise. = money/product, In the long term, product increases drive the inflation down. so the monetary policy is the key dimension to control the inflation in the short term.

#hashtag: investment

I'm shorting Bonds, waiting is so hard, especially face the loss. be patient, be rational!

When the U.S. manufacturing industry moved to Japan, Korea, China, lots of other jobs were created for people.

How will normal people live after AI replaces most of the jobs? That is an interesting question to investigate.

How will the U.S. Navy remove the collapsed bridge from the water? the bridge is so heavy that it can't be lifted by a crane. bomb it? that's a interesting engineering problem. the news is show they are planning to cut it into pieces and use multiple cranes to lift it. I will keep an eye on how they do it.

https://www.wbaltv.com/article/baltimore-key-bridge-collapse-update-death-toll/60341894

https://mp.weixin.qq.com/s/AA9mNVX6YEe5j_aKCT3pmQ

这本书主要说的是全球的人口老龄化导致一系列的危机,可能超出人的预期,这也是我们现在预期中国未来30年陷入日本化的主要论据

截至目前,它完全正确,但是它忽略了一个变量:ai robot, 人口老龄化的速度远远慢于ai在生产制造领域替代的速度。

对未来有没有信心,可以以现在为坐标,观察:

据我观察,这些指标都在以肉眼可见的速度下降,很多gpt moment会不断涌现,短期我在实际押注的是特斯拉的 FSD GPT MOMENT, elon 说不是今年就是明年,我相信它.

通胀,通屁涨,准备迎接由生产力提升带来的优质通缩吧,美好的日子要来了.

#hashtag: investment

FOMC Metting and Powell's dovish speech drive the stock market up. I guess it's low risk to hold stocks until 03/29 PCE data out.

#hashtag: investment

NAR's settlement allowed NAR to pay $418 million to recent buyers and modify the rules to potentially reduce commission fees. This could lower housing costs and ease some inflation pressure.

#hashtag: investment

TK教主在微博,如果遇到一个看起来很傻又不想反驳的人,就会盲转发:“盲猜关注列表的时候又到了”,我每次去点开看那个逻辑有些奇怪的人,其关注列表都会是:军事,搞笑,娱乐类的博主。

是长期关注这些导致了人的思维和逻辑封闭,还是思维和逻辑封闭的人才会长期关注这些?估计没一个准确答案,唯一能确信的是:信息的接收渠道,信息的选择,决定着一个人。

Be patient, don't do much, follow the rational plan. grow up steadily.

澎湃新闻:“近日,MIT团队将聚变反应堆的每瓦特成本几乎降低到了1/40,让核聚变技术在商用成为了可能。”

这个新闻说的是一个MIT团队在磁约束小型化上取得的验证成果,没有特别新的突破,

MIT在搞一个类似ITER的项目SPARC,磁约束上的区别是SPARC是高温超导,ITER是低温超导, SPARC小四倍

SPARC目标是商业化,这和ITER的基础研究目标不一样,目前看SPARC更有可能实现初步的核聚变。

Never give up,未来比想象更美好,更现实

ECB's interest rate cut will boost U.S. bonds and stocks.

However, U.S. bond yields may be massively changed by the CPI data on 03/12. be cautious.

Yesterday's PCE data showed a MoM of 0.4%, which was within expectations. The market has already priced in the hot CPI and PPI data, causing a decrease in bond yield. However, this doesn't mean inflation is over. A 0.4% increase over 12 months equates to 4.8% inflation. Will it cool down? We'll need to wait for the CPI data on 03/12.

invest strategy:

#hashtag: invesment

Btc, an attention-driven business, will peak in an economic ease cycle before declining. Eventually, it'll reach an attention limit, lose public interest, and fare worse than gold.

#hashtag: invesment

Despite high inflation expectations, Treasury bond yields are declining, possibly due to risk aversion-driven demand before PCE release. This is evident as the stock market drops and short-term yields rise back today, while long-term yields still fall.

#hashtag: invesment

TLT price ~= Treasury yield change

example: US 20-year treasury yield change from 4.4% to 4.3%,

#hashtag: invesment

Let warring ways be banished from the world.

Let justice everywhere its carpet throw.

May Friendship reconcile ancient hatreds.

May Love grow from the seed of love we sow.

Forgive me, God, or whatever you are. Whether you forgive me or not, I don't care.

What I should do:

I'm somewhat down today. A high amount of listening has made me not want to do anything. I'm tired!

I need some change.

Can't wait to announce that I'm a fans of the animated sitcom Family Guy.

https://www.youtube.com/channel/UC7fZ-QNFi7amcOncIl6owxA

What happens to guns that nobody wants any more?

In U.S. police departments, many firearms are kept from confiscations, buyback programs, and other sources. There are usually 2 ways to dispose of them:

But what people commonly don't know is that a company called Gun Busters provides a free service. They will destroy the gun by just destroying one piece like the receiver or the frame (which is allowed by law). However, the problem is that the gun isn't fully destroyed. They also sell the materials to others, and these materials can be used to make new guns.

In just one second, a little boy lost his mother in Gaza. There are thousands of unseen tragedies in the war.

前几天我买了个森海赛尔的耳机,包头的,有线,原因是我的旧的森海塞尔有线接触不良,经常需要转一转插头到一个特定位置才能听到双声道。买包头的因为想隔绝环境音+不要漏音,买有线是觉得简单,不用充电,森海的音质也好。淘宝上一般三百多,有一家店只要159。

我觉得可能是有线的买的少了,有些要清库存就低价,于是我选择了159的,等了2天,满怀激动的心情我拆开了它,刺鼻的味道,不灵活的伸缩告诉我这可能是假货,于是我准备退货,但是我知道卖假货要退一赔三,我去找店家申请。他当然是不同意的,于是我曉之以情动之以礼,顺便淘宝投诉假货,他妥协了,退款,赔我一百五,加耳机送我。

于是我拿着赔偿款可以够一够next level的耳机了,看评测,发现舒适度排行第一的耳机Sony WH CH720n, 索尼的无线耳机xm4我买过,重,不舒适,降噪虽强但是极度不适应,所以出了,这个720号称是索尼最轻的包头耳机,于是我决定给他一个机会。

已经等了两三天了,我不想再等了,京东769次日达,淘宝海外自营679,2天后达 当然是选便宜的,本来下单了,看到了同城自提只有10km,又心痒了,没骑一会,大货车呼啸带过来的灰尘让我想起一句话:“不要花时间在低于自己时间价值的事情上”,一个闪送三十块,干嘛要自己去取。来都来了只能硬着头皮去继续骑,只能安慰自己我是在体验贫穷,好让我知道没钱是多么艰难。出了绕城,来到一片工地包围的写字楼,终于拿到了货。命运的齿轮开始转动,心情从最低谷开始上升。

轻,舒适,一路回家听完2集podcast,戴着骑车也不冷,这让我很是开心,支持同时连2个设备,好好好,折腾一番,戴着跑步,稳定,还是轻,比xm4好多了,第一次体验这样安静的环境,激情的音乐,纯粹的跑步。

事件就是这样的事件,我觉得很有意思,第一次打假维权,买到超过期望的耳机,不用担心图书馆空调噪声等了。但是我喜欢强行总结点感悟,那就感悟点吧,不要花时间在低于自己时间价值的事情上面,但是花了好像也没那么糟。还是多折腾,多改变重要,总是会有惊喜。

Just came back from the New Year's Countdown Activity. 2023 is gone, the past year is full of loving memories. Thanks to all the people who have come into my life, with your love, I have the courage to face the unknown future. I love you all.

In 2024, I will do my best to love, love my family, love myself, love my friends, love the world.

A human's structure:

Recently, I've been unable to focus. My brain is full of noise, busy surfing, catching new things, but I can't foucus on the job that I should be doing.

Yesterday, I tried not to use a PC, or pencil and paper to make a plan of how to write codes, just in my brain. At first, it was so hard. I couldn't even remember the idea that I just thought of, many other things distracted me. The outside world is so attractive, people are moving, talking, the metro is arriving at stations, cars are passing by. How is Blue's competition going? How will the stock market go? Will PCE go up again?

I tried to create some containers in my brain to hold my thoughts. They're rectangular box, I put the plan from top to bottom, first, second, third. The box is emptied again and again because I can't remember what I just planned to do, but when I tried sometimes, those boxes stick in my brain, what I need to do is so clear.

Now I know the reason why I can't focus, why the outside world is so easy to distract me. I lack inner thinking. Nowadays, I can easily write notes and sync them across all my devices, but my brain is exercised less and less, then I will lose the ability to store, process, and recall information in my brain.

#time: 2023-12-26

Yes, you read that correctly. Today is Tuesday, but I'm writing last week's report.

Last week was full of mess:

The main reason for this mess is that I didn't have clear priorities, just did what I remembered. When things started going bad, I didn't have a buffer to handle it. I have reorganized my priorities:

When time switches to these priority zones, I should focus on them, not keep other things in mind.

#hashtag: WeeklyReport

Mouse is a mental status invented by me to describe a status that I need to do a hard thing, but I'm not want to do it, i'm avoid to face it, surf the internet, do other things, but eventually I also need to do it.

When I'm in this status, I need to :

this week:

Next week:

#hashtag: WeeklyReport

Yesterday, I was anxious about what I was doing. When I remember the past year of my study and work, it was just so-so. Sometimes I could find something to pursue, but most of the time I was driven by events. I didn't do something that I was really satisfied with. I have wanted to learn English for almost 10 years, and have been running intermittently for 7-8 years. I didn't do it really well, things just happened to me, and that's it. No more, no surprises. This year my running and English skills are better, not because I have changed my performance or mindset, but simply because I have had more time to do it.

When I started to learn English with Xuan, I found that my problem is my attitude towards life. I'm a "just ok" man, and usually fool myself into thinking that I'm doing well. My English learning process is the best example. I know English is my most important skill, but I didn't really take it as the most important thing to do. Sometimes I watched movies, sometimes I listened to podcasts, and sometimes there were many other things that interrupted my learning progress.

Upon deep thinking, I know that what I lack is the courage and ability to face difficulties.

I know I don't need to do all of these things good, and I can't do all of them well. But what about my dream? How can I achieve my dream? If I'm sloppy in all things, I will never get it. It's time to admit it.

This week

Next week

#hashtag: WeeklyReport

Recieved my new MacBook Pro today, It's faster, more battery life, but why I'm not excited as before?

with hundreds of practice, and the help of https://www.youtube.com/watch?v=QAHg7h80-KQ, I finally got the -lee sound.

the key is to make mouth more wide.

Today, I spent some time trying to follow the RAZ video to shadow read the sentence, but the first one sucked. The sentence is "Insects have many kinds of wings."

Insect, wings, kinds, are the words that I mispronounced. I corrected the “t” in Insect, and “-ing” in wings, but the biggest problem is "kind". Most of the time, I read it as "canned" or "cans" or "candle". I spent whole day try to correct it, but still can't get it right. all the words with -lee sounds i can't pronounce it right. like:

I always pronounce it as -nee, I had tried compare the wave form, shadowing, but it's not work, even my wife and daughter that can pronounce it right, but failed to correct me. Haha. there must be something is wrong, I will find it out.

Today, I launched my English app and received much feedback. I'm very glad it works without any major problems. I have many things to study and many challenges to face, but I will make it come true.

I have been learning English with Xuan (X^2) for 3 days. Every time, she gives me refreshing and new shocks. She is an incredibly interesting person with very high standards in everything. Studying with her is full of challenges, but the feeling of excitement and hope is so unforgettable.

With her help, I found that what I need to do most importantly is to get much more comprehensible input. It's not just about listening more, but also about building my high-quality transformer system.

An unkown way may not lead to your destination, but absolutely it will lead you to a new world.

I met a fantastic person who is incredibly interesting. We chatted from morning until now. She pointed out my English problems very deeply, and she is very talented at drawing and exploring. She is very good at English and full of love for life. I'm so happy to have met her.

Begining today's work, wishing everything goes well.

Yesterday, I reorganized my blog and found that what I write about is shallow and fragmented. I should increase my output, write down the things I'm learning. That is an indispensable way to learn.

This world is filled with people who are more professional and greater than you. I'm so jealous of them. Why didn't I become them? Why are they younger than me and more successful than me?

Actually, I know the reason. I didn't spend as much time as them, didn't try as massively as them, didn't discipline myself as they did. I just wanted to do little and gain more.

Now, I'm writing this down, and I'll get some sleep, and fight again when I wake up.

Keep fighting, you stupid old man!

量子计算就像飞机,古典电脑就像汽车,飞机不会取代汽车

#hashtag: thoughts

You should never use local language subtitles to learn English. This is because your brain will force you to think in your local language. Try watching this video with Chinese subtitles, you won't recognize the vocabulary and will just understand the meaning in Chinese.

#hashtag: English

I should try to write summaries periodically. When I'm not working in a company, I don't need to write a weekly report finnaly, but I also miss the chance to think, review the past, and plan regularly.

So I decide to write a summary weekly, monthly.

Work finished:

Work not finished (expected to finish over the weekend)

Next week's plan:

#hashtag: WeeklyReport

A = Good sleep, regular exercise

B = Not enough sleep, no exercise, tiredness, stress

X = Eagerness to do things, doing it right now

A + X > B + X > A > B

In the past year, I have tried to make an effort to achieve A, but it hasn't worked as expected. Despite plenty of sleep and regular exercise, I still didn't have much motivation to do things.

I find the best way is to continuously build an environment to try to solve the problem that's on my mind. To build, to code, to write. Even when I'm tired, my memory is weak, and my brain can't focus, I can still try to nail it. And make some progress.

念念不忘,必有回响,比单纯良好的物理身体状态更能激化行动力。

Stew with mushrooms, vegetables, eggs, rice, shrimp, and beef balls. It's too hot, so add a generous amount of ice.

Finish a day's work, then go back home. See the beautiful sky with airplane trails. It's so beautiful.

#hashtag: life,beauty

The new blog is complete. The main features of this update include:

I'm easily drawn into building or fixing things, like repairing a water tap, keyboard, replacing a battery, fixing bugs, changing a UI. Even when it's not cost-effective, and buying a new one might be cheaper, understanding the problem and fixing it brings me joy.

The total cost is 3 days. I need to get back on track with the APP development.

#time: 2022-11-30

Today i got a interview with Applovin, The headHunter said it's seeking a devops leader , cause Applovin is a oversea company , so i got try this job , maybe it can support transfer, but things goes weird , i see the position at email is devops engineer not leader, and the question in interview is very basic:

first is a coding test, write a function to implement loadblancer,giving some ip with ranks, i calulate the probability with sum total ranks, and use random number to test is hit in this probability, but i get 30 min to implement this function, maybe takes too much time , I'm so poor of algorithm test.

and then is question of how dns work, tcp udp difference, and what middleware i had operate.

finally, they end the interview, i thinks there is some misunderstanding of the positon, they maybe only need a experienced ops, and the headhunter said they need a devops leader.

anyway, thanks this interview, get me to know how online algorithm coding test works, and i have much more work to improve my express.

今天有个Applovin面试,猎头说他们在找一个devops leader,因为applovin是海外公司,所以就试了下这个工作,说不定可以支持transfer,但后面就有点奇怪了,email上看到的职位是devops工程师不是团队负责人,面试的问题很基础:

首先是代码测试,写一个实现负载均衡的函数,给一些ip和ranks,我加起来总的ranks计算每个ip概率,然后用随机数来测试这个概率是否命中,但是我有30分钟来实现这个函数,也许需要太多时间了,从大学之后就没刷过题了。

然后是 dns 的工作原理、tcp udp 差异以及我运维过哪些中间件的问题。

最后,他们结束了面试,我认为这个职位有些误解,他们可能只需要一个有经验的ops,而猎头说他们需要一个devops leader。

无论如何,感谢这次面试,让我知道在线算法题是如何工作的,以及我还有很多工作可以提高我的表达能力。

just rewrite my blog, added a new feature named moments , for post short message like this.

✿✿ヽ(°▽°)ノ✿

Copilot can not only help you write code but also help you write anything. I use it to correct my English grammar.

#hashtag: tools

RecordRTC is a simple but powerful screen recorder (Chrome extension), and it's free. I have tried a lot of tools that require payment, but they are not as simple as this tool and are too complicated.

https://chromewebstore.google.com/detail/recordrtc/ndcljioonkecdnaaihodjgiliohngojp

The author is https://muazkhan.com/

#hashtag: tools

Life is consist of many project with deadline, but usually people did't recognize that it has deadline:

Old is you Can't open new project, and your old project closed one by one.

So, when you were young, open as many as the project you love, take care of you projects, there is no in the future it will different, only the Right Now you can enjoy, you can change.

#hashtag: thoughts

读《Atomic Habits 原子习惯》 有感, 这本书值得读一读

自我修炼其实只是 加法,远没有乘法效应那么可观,做几分得几分,能跑了就能跑,能读英文书了就能读,也仅此而已,没有多fancy。

不是屠龙术,但是却是一切的原点,0x啥都是0, 1x啥就是啥,2x啥才开始产生量变,我自己觉得我之前很多地方都是0,现在也仅比0多一点点,还远没有到1,更没有到2。导致我做啥啥不行,英语不好失去会多机会,自制力不行卷不过别人,规划不行浑浑噩噩这么久才发现做了很多无用功。

好在0到1的过程让我满意,让我有打碎自己重造的信心和动力

#hashtag: book

What you believe determines what you do, what you do determines who you are, who you are determines what you believe.

believe that you are the person that you want to be.

then act like the person you like to be.

then you will be the person you want to be.

以前我觉得得到我想要的,就是定个目标,按计划一步一步实现它

我定了很多想要目标,基本都没实现,理想和现实差距总那么大,我总是自责自己自制力不够,懒惰,分心

到最近我才慢慢发现差距在哪里:

其实这些个目标只是美好的想象,从没有在我的心里真正的扎根,只是个愿望而已,许完了,该干嘛干嘛,有时候挣扎一下,过一会又被别的事情充满我的时间和生命》

我的生命被微博,推特,吃零食充斥,各种信息的,物理的零食充斥着我的时间,工作的时候钉钉消息占据了我大部分时间,不是工作就要处理那么多消息,而是我实在无法抵挡回消息被动处理问题的快速多巴胺反馈的诱惑,这些短的有效的多巴胺已经形成了习惯。而习惯是什么呢,就是随着你进行的越多,越自动,阻力越小,你越是做它,我是真的喜欢这些么,肯定不是,但是你说我能离开他们么,明显不能,下意识的动作已经支配了我。

打破这种局面的,是我有大量时间去和这些做斗争之后,新的时间空间,让我有余力去体会新的事情,新的事情形成习惯,让我逐渐的产生对比,“我” 这个body, 肉体,宁克凡,四岚,想要什么东西,我讨厌那种被肉体支配的感觉,在厕所拉屎都想要拿出手机刷一刷,偶尔想克制不刷,还是止不住的想在口袋里淘。

我逐渐发现我想要什么,我其实想要变强壮,我更喜欢跑步慢慢把我变瘦,让我能控制我自己的身体。我想精力充沛,这种想法开始对晚睡的习惯产生冲击,开始动摇那些支配我的习惯,我现在才发现有效的改变不是我设定了一个早睡的目标,慢慢去尝试,训练。而是我从内心深处,知道自己是一个什么人,我应该是个能跑马拉松的人,我应该是个整天工作不困更强壮的人。

当然这里面不是那么简单的:因为相信,所以看见。它包含了很多尝试,很多失败和成功,很多你自己的经验积累,这是一条:你是谁->你想要什么->你做什么->你得到什么 的探索路径。不用鸡血,也不用比较,别人真的不重要,这只是你自己一个人的战斗,有梦就去追,累了就休息,只要自己内心认可,往前每小一步自己都会满意。

你会发现你最不能满意的,就是你和你内心的方向不一致,身体和内心产生了冲突,产生大量的内耗,甚至让你绝望,顺应自己的想法吧,那怕你审视之后,发现我就是要吃零食,即使产生严重后果也在所不惜,那么最优选择应该是去吃。

如果你经常心里挣扎,纠结,这其实也是一件好的事情,这说明你的内心已经表达了自己,你要做的是好好听听它的声音,做一点你想要做得事情看看,慢慢这颗种子,会带着你往它的方向走。

what inspire me from this video is Taiwan Youngs' hopefulness and resilience, even in the midst of struggles, they strive to move forward.

https://www.youtube.com/watch?v=I2CK-j-pR7M&ab_channel=CNAInsider

https://www.bilibili.com/video/BV1F3411Y7vb/?vd_source=094e181c6a3bed77aef21259547b84fb 刚看这个纪录片,是从 https://www.youtube.com/watch?v=db6kNqZ8iZY&ab_channel=%E4%B8%80%E7%9B%AE%E5%8D%81%E5%BD%B1 一目十影的速看找到这个片子的。

看完心情不能平静,想说很多话又好像没啥说的。

孩子过早的独立=父母的缺席。youtube这这句评论打进我的心里,期盼blue和snow能早点独立,又舍不得他们慢慢变大。

人都是需要爱的,想想我也给她们带来过很多伤害委屈,所幸他们还在原谅我的冲动我的生气,不是父亲这个身份给了我归属感,而是一起长大的陪伴给了我珍惜的动力。愿所有人能生活在一个友好,有爱的环境。

另外今天跑步的时候,有个单眼好像残疾的人叫了我一下,我潜意识感觉是什么麻烦,惯性的没停下来,走了100米心里纠结这会不会违背自己的原则——帮助他人。又犹豫大概率是要钱什么的有必要专门回去么。几经反复还是折返回去问下什么情况。所幸只是之前遇到过的假装困难要钱的,给他买吃的也不要。

我现在的思考是为什么有的人衣食无忧在顶级学区用顶级资源在卷,为什么有的人10岁了上不了学需要照顾2个妹妹还没有爸妈陪伴。肯定不是因为努力,说运气其实也说不上,投胎也只是表面,而是作为一个人类整体,无数人的集体贡献,造就了今天高度发达的人类社会,虽然这个社会有不少短板,但是已经让无数人过上了相比茹毛饮血的原始社会高几个量级的生活。这种社会的演进,互助贡献了很大的力量。

我们都是人类,生理上没什么差异,见识经验上差异虽然巨大,但是不能把结果过多的归咎为自我努力,更不能嫌弃,指责其他人。能力越大,责任越大,做已所能及的帮助别人的事情吧。

The benifit of do multiple things is:

Every little boy that was refused by his short and thin body, may became the world champion of football in the future —— with respect to Messi

不管做不做,外界照样转 不管做什么,外界照样说

我改变不了外界,但是可以改变我自己 每一次的行动,都是下一次行动的垫脚石, 在这一次,我克服了恐惧,我克服了担心, 为下一次,积累了一点力量

这力量让我安定,让我相信自己,这就够了。

为每个敢想敢做的人开心,希望这是未来的自己 为每个敢想不敢做的人支持,做梦是自己行动的第一步 为每个不敢想不敢做的人尊重,世界需要可以不做的自由

为每个diss别人做梦的人惋惜,diss or 不diss 世界还是那样蓬勃发展,而diss为自己设下了一道栅栏,强化了自己的人设立场,降低了更多的可能。

life is a experience, thanks for what I experienced, pity what I didn't tried.

人生终究只是自己经历的总和,和太多人来来往往交集一段又各奔远方,所幸我之过往,不幸我所未尝。愿未来随心所欲,愿未来同好欢畅。

谨慎训练自己,认真照顾家人,善意对待他人。

Culture bring us together. when Taipei sing the lyric of "河北师大附中(The Middle School Attached To HeBei Normal University)", its a tearful moment.

walk between desperate and hopeful. Keep trying, Nerver ever give up!

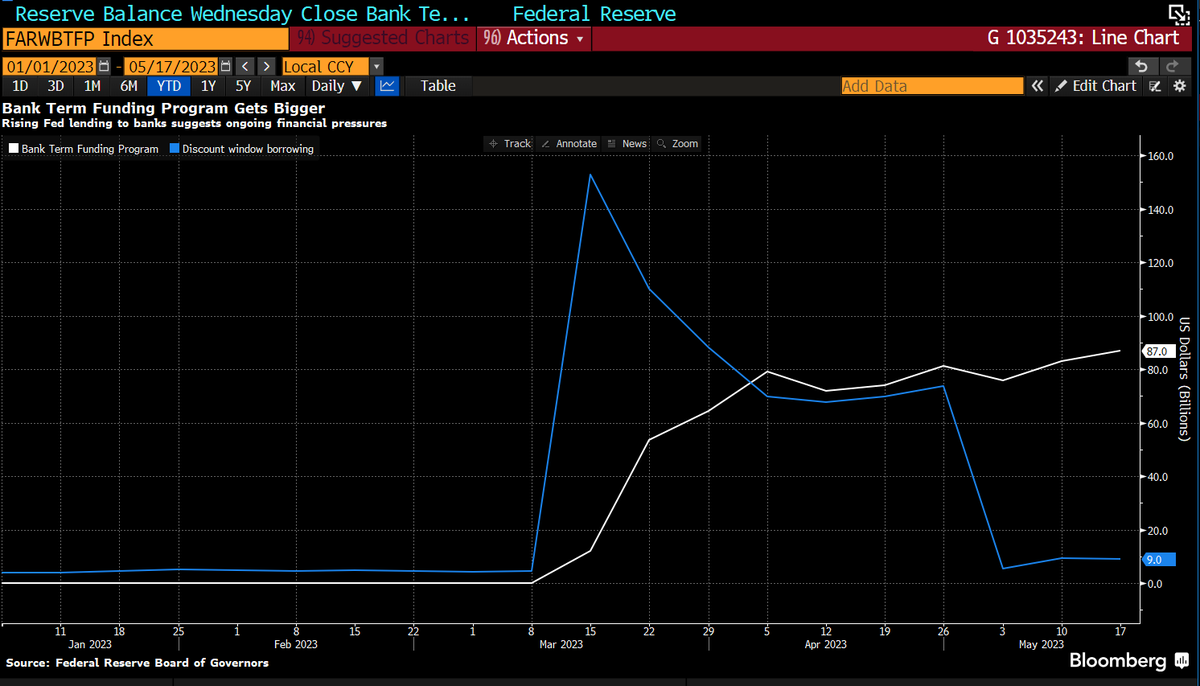

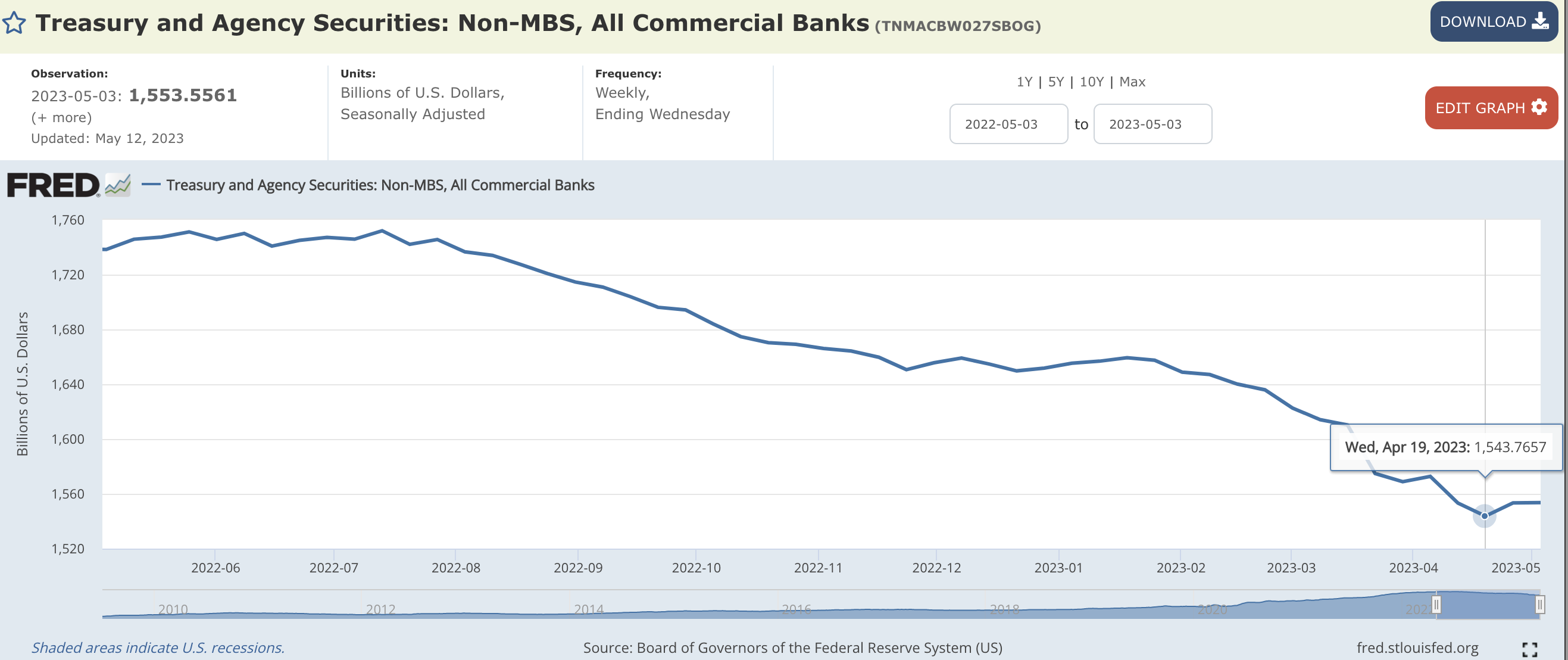

Bank borrow from FED through BTFP is rise:

They are selling Theasury Securities.(data updates at 2023-05-02, but base on recent days Bonds yields rise, and deposit decline, I think they are continue selling to make liquidity deposit.)

So I guess, the bank crisis is going to emerge again in the nearly future. the Bonds price will going down in short time (cause the banks need sold their bonds to get liquidity) , but when the bank crisis is unmanageable. the fed is going ease rate, the Bonds price will get a good chance to go up.

心似已灰之木,身如不系之舟

问汝平生功业,黄州惠州儋州

我们的国家,我们的民族,我们的历史发生了太多因为战争而生灵涂炭,骨肉分离的悲剧,我讨厌任何的战争,暴力。我会:

https://www.youtube.com/watch?v=jd4eL_48Ww0&ab_channel=CNEWS%E5%8C%AF%E6%B5%81%E6%96%B0%E8%81%9E%E7%B6%B2

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4412788

A paper use ChatGpt to predict stock return use News headline. their prompt:

Forget all your previous instructions. Pretend you are a financial expert. You are

a financial expert with stock recommendation experience. Answer “YES” if good

news, “NO” if bad news, or “UNKNOWN” if uncertain in the first line. Then

elaborate with one short and concise sentence on the next line. Is this headline

good or bad for the stock price of company name in the term term?

Headline: headline

the result shows LLM has the ability to judge a news is a good or bad news for stock price, but I think the method they use in paper is basic, normal investor maybe can do better than the AI in judge bad news. but the value is we can use AI to improve our invesment knownledge and the logic relations of company or bond growth.

and basic AI can automatic performed, so we can use AI to do massiave task to the the thing we used can't (likes collect all news and twitter comments to summary market voice to help us better decision).

Yesterday US Flash manufacturing PMI and services PMI comes in above expectation, services PMI expected 51.5 Actual=53.7, Bond yield goes high, price down. TLT plunge 0.6%.

economic hot means inflation stubbornly continues, that's make the investor who expect FED quickly cut interest rate disappointed and leave bond market.

updated logic link

Linear regression is a powerful and easy tool to analyisis market, It's solve the problem of that when use Moving Average to predict price probability. it's direction is old than market, only when turn point has happened , the Moving Average turn can be happen.

but with Linear regression slope, you can see the slope become more and more high and when it's high probability can't be true, the turn point will be high probability happen. slope change before price trending change. so it's a useful tool deserve to learn.

Money is a Voting Right, it's not just a number that you can buy things, it's people's willing of wish you to do something. so invest is vote who can resprent you to do something.

Invest Bond is wish the government to do the right thing like help country grow. invest Nvidia is choose Nvidia as the present of AI infrastructure.

You should choose the best present of the market. judge them as they are a person , a inteligence.

Is Technical sector still the best present of productive ? I think it is. especially at this moment of AI rise.

A respecful older used be very foresighted to proprose the slogan of "Always Represent the advanced productive forces.", I used to think it's just a boring right but meaningless phrase. But now I know how hard to represent productive, how hard to find the pattern of solving the problem, it's so easy to be not even wrong.

Unfortunately, this slogan is not emphasized as much now. However, this slogan is not just a clichéd phrase for results certification, but rather a guiding direction for the iterative process, that is very close to the essence. For a complex intelligent agent, the ultimate goal is to find the optimal path under the potential difference. This slogan is very fundamental, but it is difficult to achieve in practice due to many traps, such as "poorly defined problems, NOT EVEN WRONG, common demand misjudgments, and individual and organizational interests being misaligned" or "precise problem definition, but old models being stubbornly adhered to due to various constraints". Although the optimal path will naturally appears as long as the potential difference exists (and is constantly replaced by competition), But for individuals with limited lifetimes, it is important to focus on whether they represent the optimal path, and not waste time on trivial matters.

Bond yield goes little up, and stock price rise much, the market is widespeard expectation that the pace of interest rate hike will slow down.

Generate AI likes ChatGPT and Claude and Brad develop so fast and the experience of use those tools shock me. I'm pretty want to buy Nvidia stock, but I had set a rule that not buy individual stock, ok, how about 10 percent?

Yesterday, the US stock market rose 2.3%, because of the SVB crisis was solved, and CPI data was as expectated. And the Hongkong stock market is going down yesterday, I think Today the Hongkong market will raise as the US market, so I'm bought XIAOMI back at 11.24(which i sold at 11.56), the price went up in the morning, reaching a high of 11.36, but it soon went down again. I sold at 10.96, and lost about 10k HKD.

I feel angry, sad, and disappointed about myself. I realize that I made a mistake by speculating and gambling on XIAOMI's stock, despite knowing that it was not a good time to hold the company. I bought it simply because the market was rising, without considering the company's situation. Additionally, I lacked the knowledge to analyze the market and made my decision based on intuition alone.

I regret my immaturity and recognize that this is a big mistake that I need to remember in life. Therefore, I am recording it.

Next:

昨日美股上涨2.3%,主要因为SVB危机解除,CPI数据在预期中。 而且港股昨天大跌跌,我觉得今天港股会随着美股上涨,所以我在11.24买入小米(前些天我在11.56卖出),今天价格确实上涨最高是11.36 ,但很快就下降。 最后我以10.96 的价格卖出,我损失了大约 10,000 港元,我是个笨蛋:

我对自己感到愤怒、悲伤和失望. 之前我在市场上损失了很多钱,但我并不生气,因为以前我只购买指数并长期持有,逻辑是理性的,定投平均价格迟早会回来(实际也是),但这次我很后悔我的不成熟。 我在对基本逻辑一知半解的情况下,刚了解一些利率知识,就迫不及待地想试试,结果很快打脸。

这是人生中需要记住的一个大错误,所以我记录下来。

接下来:

Today the plunge of XIAOMI stock price give me a leason of don't gamble.

My question to research:

Get Feedback is the key to train my self, without feedback, many things may stay Not Even Wrong, Learn in public is a technique to get feedback.

我,如果对自己妥协,如果对自己说谎,即使别人原谅,我也不能原谅。

最美的愿望,一定最疯狂。

我就是我自己的神,在我活的地方。

下一站,是不是天堂,就算失望,不能绝望。

就这一次,让我大声唱,就算失望,不能绝望。

我和我骄傲的倔强,握紧双手绝对不放。

——Just write some phrase, on the day I finally decided focus on my own practice and dream, not disturbed by the pressure and money.

Stick on a thing is not easy, especially stick on the life, stick on what I believe. But that's give me courage, give me strength, give me confidence and give me happy. I love it, eventhough I'm poor, I'm weak, But, It's me, it's real me.

A big change since me known that I was a neural network likes AI, is trun from result oriented to process oriented. From set a goal and perform it to set a enviorment and set the routine. just try and try, I don't know if it's possiable, I just know it will be possible.

I used to set a goal of lose to 75kg, and list the thing I need todo , like exercise at morning, sleep at 11pm. eventhough I had archieve this goal now, but not by follow my plan, things change a lot, I usually didn't finish my plan and I'm frustrating, sometimes I'm not exercise long time. things change from i just set the time , i need a exercise per 2 days, whatever the exercise is it. running , bicycle , or just squat.

And for the develop app, I have many idea to do, and have so much things to archieve, it's hard to schedule how i can finish it. so i explore and finish a feature and a feature, but it's just so long to the milestone . so I change to just stick time on it. forget the version 1, version 2, I have time, I can make someting in this time. things gonna easy.

yesterday I tried webrtc-vad + baidu asr to recognize text in audio files, and today i found a openai project called whisper and it's stunned me , everything work perfect especially it's can run in local, so i didn't need to afraid the expense of online service fee.

I got fever at 21/12 then the test result show that I got COVID-19, It's not very unconfortable at first 2 days, the 3 to 4 day is the hardest , I'm very weak just want stay at bed. at the fifth day i still got little fever so i had goes to the hospital, but everything is fine. now is the sixth day , I'm totaly ok now.

the things happened at these days, changed me some mind, so i want to take a time to replan my plan.

I also spend many time on meanless things and sometimes disappointed, so next phase I will be more focus on my own things.

About the work, did i want back to work now ? No, I think not, i don't want waste time on work , especially after these pandemic days. I need money to raise my family, this idea goes more strongly after these days, but not from work, work is not real stable and uncontinueable for me. I need to provide service directly to people to earn money, time is crucial, be faster!

Just see Tombkeeper share how to get the drugs for treat COIVD-19, the Hacker Spirit comes out from my mind, hacker spirit is about to discover, find the detail, connect the slight connections, then things dramatically get done.

Everything looks like normal in appearence, but the underneath hide so much things, only if you get more more informations, you can see the whole picture, then you are the GOD. i remember the time that i finally get the control access of NET CAFE, the time i finally make the application works to help me to play games. the time that i earned money to buy the computer by help the ZYK fans votes.

I like the TA-DA times, when i going to work, i leave this way far more, for earn money, working as normal, as a part make company, bussiness work and grow. that's work, but just work.

I want to do the thing that I can control, the thing that I can change ,the thing that I'm the GOD of it, not only a expert, not only professional, that's need me know the damn detail, damn information, that's need me live in a way of hacker.

Hacker is essential boring , boring in the 99% time, you need to do the damn boring thing such as learn the knownledge, practice, build solutions, improve the solutions, nobody care, nobody buy it, everybody will buy the 1%, but only you know where the 1% comes form.

If you are tired, you'd better to get a rest, a nap, close your eyes, think about nothing, let it go, that's will be very helpful. after a nap, your energy will back immediately.

If you struggle to hold on, that's maybe will let you finish some works, but that's unsustainable. it will be harder and harder , then get you down. it waste more times.

First is sport, regular sport can let you more peaceable, let you believe that you can easily control your body, worth noting that you need find a right way to take sport, wrong sport way can make you tired, hurt, and frustrated. you need get the knowledge of how to warm up, how to relax muscle, how to monitor your body, how to drink etc... It's definitly a serious thing.

Second is creating, write thoughts, share knownledge, provide service, everthing thats make you produce ideas, speak out your worries to friends is also helpful. somethings it's not need to be that formal, just start is success 80%. Your goal, intrests is come from those normal little things.

I think mix english and chinese content is not friendly for reading, so i'm consider how to support multi-language. but it will after i finish my IELTS. there will be a big architecute refactor of ValidSpace.

How to win the fight with the big company: big company will focus on their own solutions, the solutions will go very deep, their technology is fancy, but not focus on the real problems, it will be competitive in the field like universal platform, underlayer service , but because the jumbo size they are not really sensitive to particular customer needs, so the service that directly fulfill the particular needs (not universal solutions) will gets more opportunity to survival.

What I'm lack now: that's a critical question that i need to answer, first I'm get many distract, and I'm lacks the experience of long time schedule and get big project done, in past serval month the excercise, english, programmer get some progress, but i still need to clear how reach the future, how to clear the final goal and the pathway, that's a big topic, so i will open a single topic to talk about that.

buffer is important: why people need use their all time to work, study, or do someting, or if not do that They usually will be considered as not hard working, but everything has it's own pathway, if we want achieve the goal, we need to find and follow the logic, not how much hard work. like running, jogging, you need to know how to be healthy excercise, how to adjust when if you failed your plan, and then is keep the routine, you can't short the time to achieve the idea cardiorespiratory capacity, your body, muscle need time to grow up. so don't push you too hard , keep you on the track and move , it is not important that how slow the progress is, if only you can satisfied with the advancement.

when we plan to do something, there will definitely be wrong, unpredictable thing waiting us, if you have much buffer, it is easy to adjust your rhythm and accomplish the plan, when we literally accomplished our plan, then we will get more buffer time to set and finish our goal, not struggle in single circle. like (hard excercise=> hurt or tired=> stop=>feel bad=>hard excercise, or work hard to earn money => tired but not competitive => less opportunity => work more hard).

fly to home.

have a sweet dream. with sweet song, with sweet heart.

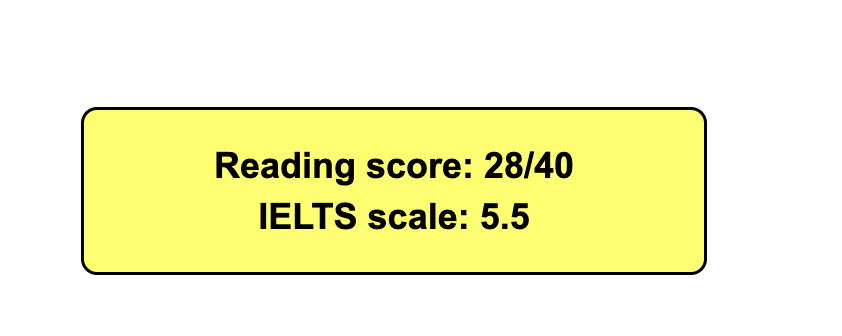

it's not easy day. i'm nearly crashed. when i do the listen and reading test , block of unknown questions get me anxious, feels very bad.

then i stop do test, watch youtube and do test again carefully, things going calm down, the score finally gets 6. it's more confidence now.

anyway, it's a productive day , i didn't spent much time in browser fragment informations, completed daily routine,

everything goes fine.

今天不容易。 我快崩溃了。 当我做听力和阅读测试时,一大堆未知的问题让我感到焦虑,感觉很糟糕。

然后我停止做模拟题,看了一会youtube再仔细做模拟题,事情逐渐平静下来,分数终于到了6。现在更有信心了。

反正今天是收获满满的一天,浏览器碎片信息没花太多时间,完成了日常,还好。

Today is the first day that Hangzhou eases the COVID control policy; now you don't need to get a PCR test every 3 days to get into the metro, buses, and other public places.

Even though your health code will still be checked, any other code that is not green will prevent you from entering a public place. But it's a big step that will reduce many influences on daily life. People are celebrating the lifting of restrictions.

When I got out this morning, the PCR test site was still open, and people were still going to do the PCR test. What surprised me was that most older people had worn masks; in the past, very few people had worn masks in open space. That's a good thing that older people pay attention to personal hygiene.

I didn't have my PCR test checked, and I didn't have to scan the SITE QR Code; I just had to show my healthy code, and then I was allowed to take the metro and go to the library. and I still need to take a mask to those places.

今天是杭州放宽疫情管控政策的第一天;现在您无需每 3 天进行一次核酸检测即可进入地铁、公共汽车和其他公共场所。

虽然还要检查你的健康码,任何其他非绿色的代码都会阻止你进入公共场所。但这是一大步,将减少对日常生活的许多影响。人们正在庆祝解除限制。

今天早上出来的时候,PCR检测点还开着,人家还在做PCR检测。令我惊讶的是,大多数老年人都戴着口罩;过去在露天场所戴口罩的人只是少数。老年人注意个人卫生是件好事。

没有检查我的核酸检测报告,也没有扫描场所码;我只需要出示我的健康码,然后我就可以乘地铁,进图书馆了。只是这些地方还是要带口罩的。

I'm got districted morning, after afternoon's meditation , i start to control this, get put back on track, and finished the daily routine finally:

the score of IELTS still goes 5.5, listening score is 22, better than yesterday, the biggest problem in listening is i can's spell the word right. and the biggest problem of reading is unknown words. need to improve my words base soon.

In meditation , i thought that follow news is meaning nothing. i spent so much time on it , visit twitter, weibo, v2ex just want to get some useful new informations, it's just a dopamine addiction, i use so much of time seeking for cheap dopamine.

honestly, surfing, seeking easy and cheap things is my biggest problem, sometimes, i can spent whole day, whole night to do those things. how can i change (or theat) it.

Maybe, likes all problems to be soleved, first, i need to define it, second i need to measure it, then i make solutions.

so , i need to open a thread to theat it.

here is the link:slan solve his problem of distracted

在冥想中,我想到我持续浏览跟踪新闻毫无意义。我花了很多时间在上面,访问推特,微博,v2ex上,只是想获得一些有用的新信息,这只是多巴胺成瘾,我花了很多时间寻找便宜的多巴胺。

老实说,沉迷在简单又便宜的东西是我最大的问题,有时,我可以花一整天、一整夜去做这些事情事。 我该如何改变(或改变)它。

也许,就像所有要解决的问题一样,首先,我需要定义它,其次我需要测量它,然后我制定解决方案解决他。

所以,我需要打开一个线程来处理它。这是链接:slan 解决他分心的问题

time is over, i'm still surfing....

try a meditation and back on track

走神走一天了,我要死了。 从现在开始冥想下然后尝试回到正轨 o(╥﹏╥)o

My last part of alibaba shares selled now with price 91, now i'm not hold any shares of Alibaba now, the price of the day i join the company is 180, but with not pity, i'm so happy my life didn't get influenced with the stock price, every thing goes fine in plan.

我最后一部分阿里巴巴的股票现在卖了91,我现在不持有任何阿里股份了,我进公司那天的价格是180,但不可惜,我很高兴我的生活没有被股价影响,一切都很好,在一步步的规划中抵消了这些影响。

If you are in plight, then take care of yourself. If you are in a good condition, then help others.

just watched how Taiwan's Tech industry grow history, it's start with nothing, visionary likes 李国鼎,孙运璿 and so on, do so many works to grow the semiconductor economic, after decades Taiwannese companies account for 50% of world market.

And in china's history , the story of how Scholar mind the world, help the poor people is innumerable, in Chinese culture, people willing to with mission for make good things happen, willing to help each other. and if you don't have ability to help other, you can also be a good person, let yourself, your family to be better.

That's why i'm proud to be a chinese, even though hard time always coming, but family in your back, world in your front.

穷则独善其身,达则兼济天下

刚看了台湾科技产业的成长史,白手起家,像李国鼎、孙运钰等有远见的人,为发展半导体经济做了很多工作,几十年后台湾公司占世界市场的50%。

而在中国的历史上,士人胸怀天下,扶贫济困的故事更是数不胜数,在中国文化中,人们乐于肩负使命,乐于助人。如果你没有能力帮助别人,你也可以做一个好人,让你自己,你的家人变得更好。

这就是为什么我为身为中国人而感到自豪,尽管艰难时刻总会到来,但家庭在你的身后,世界在你的面前。

Now is 1:00 AM, i just heard that beijing is relax the restrictions of covid-2019, that's give me a big suprise that youth is very different from us old man. they do what they want, say what i can't imagine, and !!!! IT'S WORKS!!!!, THANKS to all people that with good heart, good wishes, good purpose(include the GOV) together to make things going to fine.

北京放宽了covid-2019的管控,这让我很惊讶,年轻人和我们老年人很不一样。他们做他们想做的事,说我无法想象的话,而且 !!!!成功了!!!!,感谢所有怀着善意、美好愿望、良好目标(包括GOV)共同努力让事情变得美好的人们。

Now is 6:14 PM. prepare to back home now, Honestly I feel tired now, i didn't sleep well at recent days, first is because i didn't schedule my routine well, and today i spented much time to surf news, but still feel satisfied that i complete :

keep moving , get quickly to recover!

老实说我现在很累,最近几天睡不好觉,首先是没有好好安排自己的作息,今天花了不少时间刷新闻,但还是很满足的完成了:

加油,尽快恢复状态!

I'm going to dead, that's my first IELTS reading practice test, it's got 5.5, my goal is 8, I'm alread dead..............

第一次雅思阅读自测,5.5分,omg,我要死了,我想拿8分。

I found that I was snored when sleeping(I use MI healthy App to record sleep and snore), especially when i got short sleep time, I have bad hadbit that some day sleep after 1:00 AM, if i sleep more than 7 hour , it probably will not snored that night.

The time that i first find i was snoring was at Shanghai lockdown, those day was tired and get sleep very very bad, some day only sleep 1-3 hours(cause need to work at night), i found everybody of my colleagues will snoring, and a colleague said i was snoring too, but not much time. so i think when people get tired , of sleep late, the body need more air immediately,so people will probably get snoring.

我发现我有打鼾的习惯(我用小米健康app监控我的睡眠和打鼾),特别是睡眠时间比较短的时候,我有时候一点之后才睡,如果我睡够7小时,一般不会记录到打鼾。

我最开始发现我会打鼾是在上海封城的时候,那些天非常累,常常睡不好,经常只睡1-3小时,我发现每个同事都会打鼾,有个同事也说我会打鼾,只是没那么大声,所以我觉得人在劳累,睡太晚的时候,身体需要更多的氧气来恢复,所以常常会引发打鼾。

It's snowing at Hangzhou, very happy play with Blue. she is very exciting that can get a snow fight.

杭州下雪了,Blue能打雪仗她很开心。

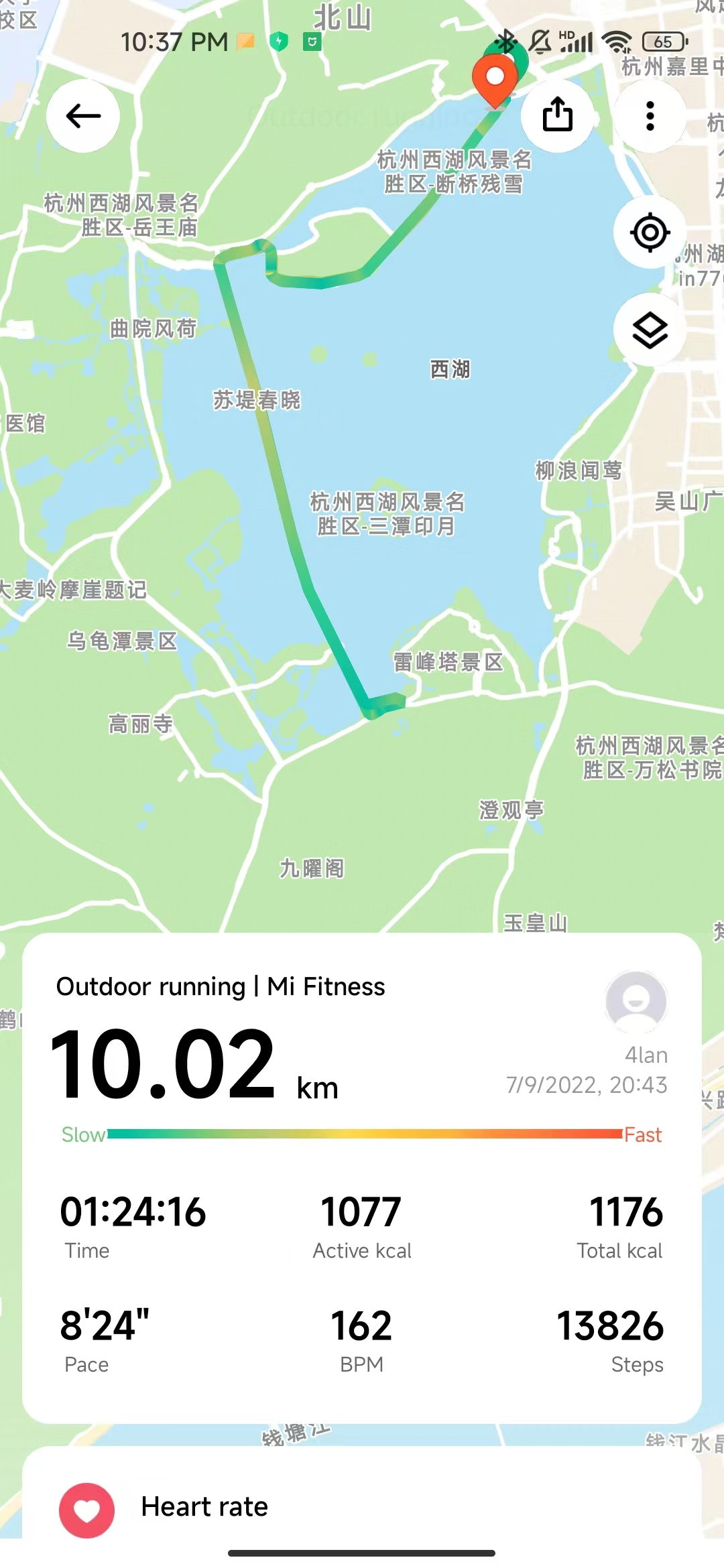

继续老路线梅家坞,求快而不得。节奏不行,忽快忽慢。

数据

杭州四十度天跑步是不能跑了,骑行还挺合适,特别是从玉泉进入景区的那个点,很明显的很感受到,外面热浪里面清凉一条分界线。

今天有个很有意思的事情,是有辆警车拦停我2次,第一次拦截失败,在我稍微前面一点停车然后我车速很快,他们还没来得及下车我就骑过去了(能明显感觉到他们从左边突然靠边应该是有什么事情),第二次在我前面很远停,然后从驾驶室直接出来,挥手势示意我靠边。 2名警察,一名拿着手机摄像还是拍照,一名来跟我交谈,说我不是犯了啥事,只是最近夜骑的人比较多,出了多起交通事故,让注意安全,不能穿锁鞋(锁鞋会和踏板锁死,踩拉都能发力,提升发力空间)。我没穿锁鞋,交代感谢之后就继续骑走了。

骑行没有什么压力,比之前感觉轻松,心率也不高,爬坡基本还是控制在160。

数据

but.....回家之后吃零食,吃冷饮,喝甜酒,喝果汁。。。。我估计不止一千大卡, OMG白骑了, 以后回家坚决不买零食,仅进货少量低脂冷饮。

晚上开始雷阵雨,骑车不得行,只能跑步了,运河->武林广场->环城西路->北山街->保俶路->文一路 9.8km, 虽然下着雨,但是因为温度低,非常适合慢跑。

数据

今天和同事继续约了跑步,这几天比较累,且没有控心率,只想跑完,心率慢慢上升直到了190。速度有些快了。

数据

状态不好,今天去上班了,上班果然比较累,好在骑行完好很多了,精力恢复了一部分。还有最近睡眠不好,咖啡+晚上运动,导致经常1-3点才睡,得想办法调整过来。

数据

天气放晴,继续骑行,今天心率控制的不错,上坡均匀,没有脱力,整体速度上来了

数据

连续几天下雨,没办法了骑车不得行,只能跑步了,跑步也不想远,但是又想10km,所以绕了一个大圈子,雨中跑步有点狼狈,不过还行,人少舒适。

数据

和同事一起约了西湖跑步,因为天气太热选择了杨公堤-苏堤环线,因为杨公堤靠山,绿化很好,温度比其他地方低1-2度,很是清凉。

后半截纯粹的快走,心率第一次压到了有氧,感觉很不错。

数据:

继续刷,今天可能是周五的原因,骑车的人比较多,多起来就带节奏,看别人超过我我就不自觉的跟上去,速度就拉上去了。。。把我累得半死。

数据

天气太热,晚上七八点出来一阵阵热浪,还没有风,这种天气下跑步,直接崩掉了。

数据

大热天在后面我走路心率都上160,跑起来就直接飚180,越到后面越慢不下来了,维持速度的阻力比减速跑的阻力小多了,后面2km我直接走了,心率还是140. OMG太恐怖了,身体失控。

今天刷梅家坞,1小时20分钟搞定,全程节奏很紧促,估计这个是这条路线的常规速度了。不过出来比较晚了,速度快了点,心率大部分在无氧区间。无氧就无氧吧,在尽量放松保持的情况下,就随它去好了,不要感觉累就行。

数据

改进点:降低心率,保持速度

昨天想去和同事一起刷10KM的,结果没去成,今天找机会刷了一次,心率降不下去,全程无氧。。。。,只能慢慢适应看看,过2周再看怎么调整把。

环境很棒,清风吹着,低速跑着不累,很是惬意,人就断桥几百米比较多,其他路段不影响。

数据:

此路线优点

缺点:

今天继续梅家坞,少了走走停停,时间缩短20分钟,期间还接了10分钟电话,预计后面能到1小时20分钟搞定

数据:

天气比较闷热,在景区才稍稍凉爽点

白天太阳太热,晚上去骑车了,不过21点才出发,自从准备控制心率到有氧区间,就不准备骑龙井了,龙井很陡铁定心率拉爆的,于是走了灵隐->梅家坞路线,梅家坞风景好很多,回来走北山街,夜景也超美,清风徐徐,湖光映着城市的一线明光,夜空清莹透彻。

实际里程和龙井路线差不多,都是25km,如果不是走走停停,中间拍照之类的,估计能控制到1小时30m完成。

心率控制得比较满意,有氧有42分钟,上坡的时候太容易超过150到无氧区间了,准备放轻松先这样吧

数据:

keep going!!!