slan's invest log 2023-05-26 (#1 Start to logging my investment)

When I bought the TMF bonds ETF at April, I opened a new world of financial investment, I had given up several times due to money losses and pressure, but i eventually persisted . So now, I want to follow my heart and take it seriously. I will log my thoughts and my action and the result every week, for help me better sort my thoughts and avoid impluse action.

Today, I will talk about:

- my trade history in April and May

- did I profited?

- what I learned

- how will I do next

History

On March 15th, I sold my Xiaomi and Baba stocks due to lost confidence in the Chinese economic, at that time I belived it was also the right moment for the FED to stop interest rate hike, so i started buying long-term Bonds ETF, fortunately i made a profit of 15%+ in 2 weeks. which give me much confidence and belive I can make even more profits, that was the beginning of the tragedy.

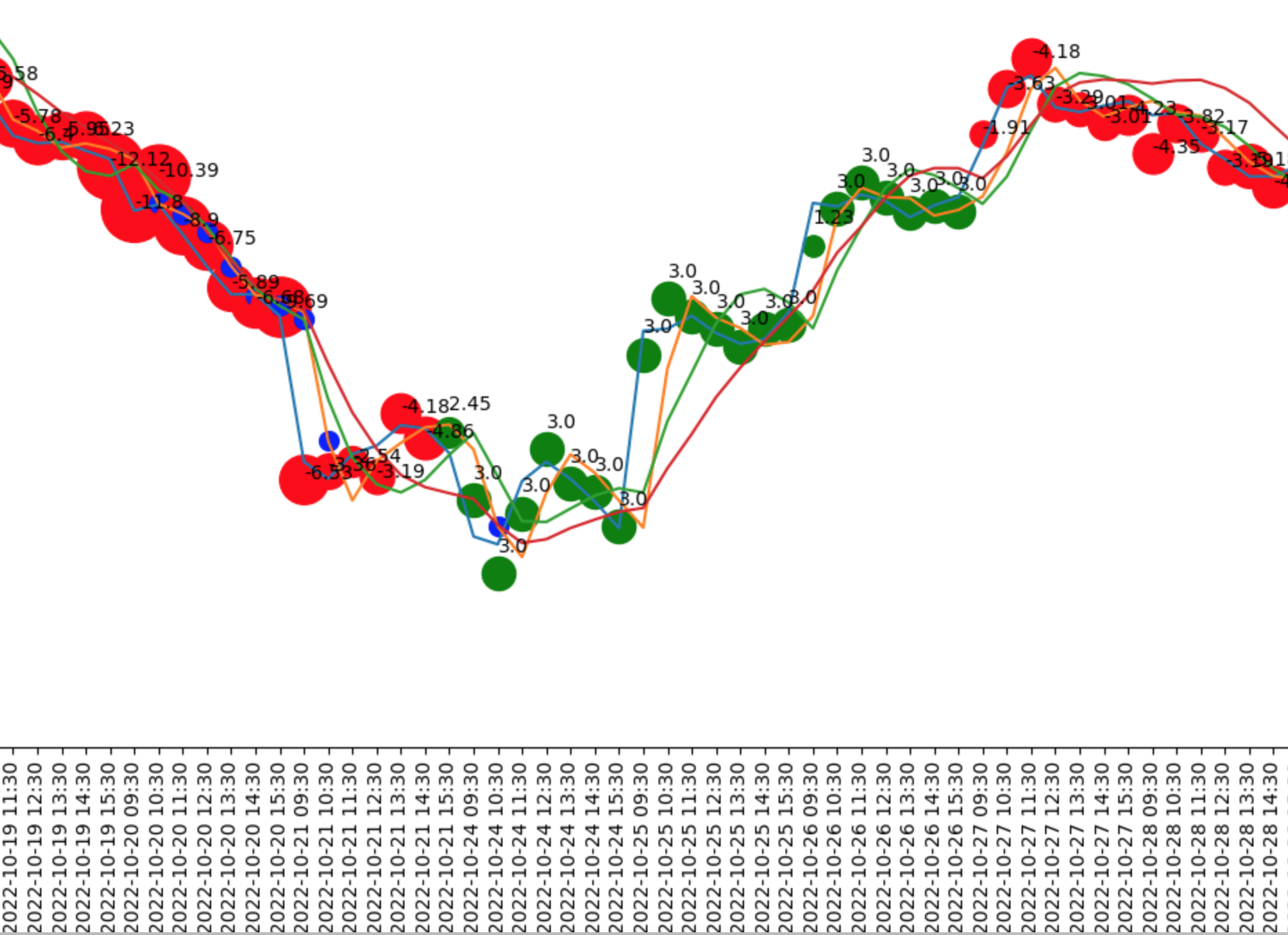

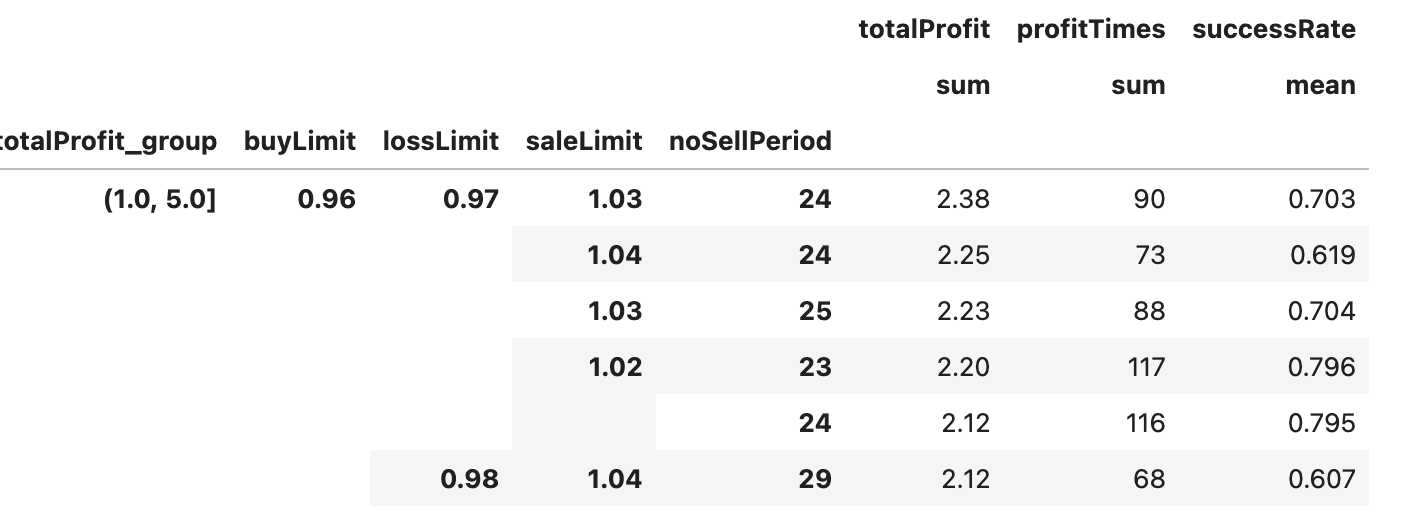

As time moving to May, the bonds price began to fluctuate, my simple strategy of buy TMF when bonds start to recover, and shorting it when too high was no longer effective , at this point, i learned how to analyze the trending, i learned Linear Regression, and use Pandas and Matplotlib to plot price trending.

I exhaustion all possible actions trying to find a magic parameter that could earn money. Te most interesting part was when I made some bugs or errors while estimating the possibility of a buying opportunity, I saw a massive profit possibility, it's return 100x in juset 2 years. I started worry about how i could spent so much money. Howerver the truth was that it's just a bug or a mistake. and there was no chance of buying at the lowest price every time. When I fixed those bugs, it turned out to be only a 2x return in two years. When I tested it over a longer period of time, I soon realized that it would lead to further losses.

In the middle of May, bond prices lost 10%, and I waited for a rebound. However, after carefully analyzing the Fed and economic data, I realized that bond prices were going to drop even further due to inflation and a hot economy. So I took the loss and started to short bonds, which helped me make some money back. However, I still lost a significant amount.

bonds demands supply curve:

the Fed's mechanism:

Now , all the profit comes from lucky, wiped out by my ability.^_^

Learn from failures

- Don't move when I'm not thinking clearly, My most lost is from FOMO or fear mood.

- Learning from failures, accept that i'm foolish, I need much learning. the economic principle is the best tools to measure and analyze the market.

- Don't chase high. and don't bet bottom, in downside trending lower is most meaning more lower.

- Find prossibility. use math and economic model to test and verify it . the model is the only way you can conitnue to profit.

- Don't spent much time on it, the price determined by logic ,not time you spent, so I will not monitor the price , only review at next day and write weekly report.

- Don't use leverage, it will enlarge the greedy and enlarge the fear.

Next action

Bonds price stop decline at Friday, and debt ceiling is reach deal, and the bank deposit looks like stop decrease. so I need to carefully look at the trending.

the good news:

- Inflation is still high , PCE in Friday is high than expectation.

- Debt ceiling is reach deal, treasury will release much more T-bills in weeks. Risk Aversion risk is disappear.

bad news:

- Friday yield is going down much, even PCE data is not good. it's present high long mood.

- GDI data point to recession.

- Foreign holds is holding more bonds.

- bank system looks like steady now. the bonds sell pressure is easing.

so I will look at Tuesday price ,

- if yield still going down , I will take lost, and look at 15 June's FOMC meeting.

- if yield goes up, I will sell TMV @130

long term plan:

- model for invesment US long-term bonds.

- regularly invest NASDAQ-100